Stay updated with the latest crypto market news and developments in the world of cryptocurrency. Discover the top blockchain stories and insights that matter to your investment decisions.

Bitcoin’s price has not mirrored gold’s record surge above $5,300, highlighting a divergence in safe-haven behavior as traders reassess risk assets and the dollar’s influence on traditional and digital stores of value.

Prices jumped more than 58% as commodities trading activity surged on Hyperliquid, highlighting fresh momentum in crypto derivatives markets and a renewed narrative among traders about digital commodities as strategic diversification tools.

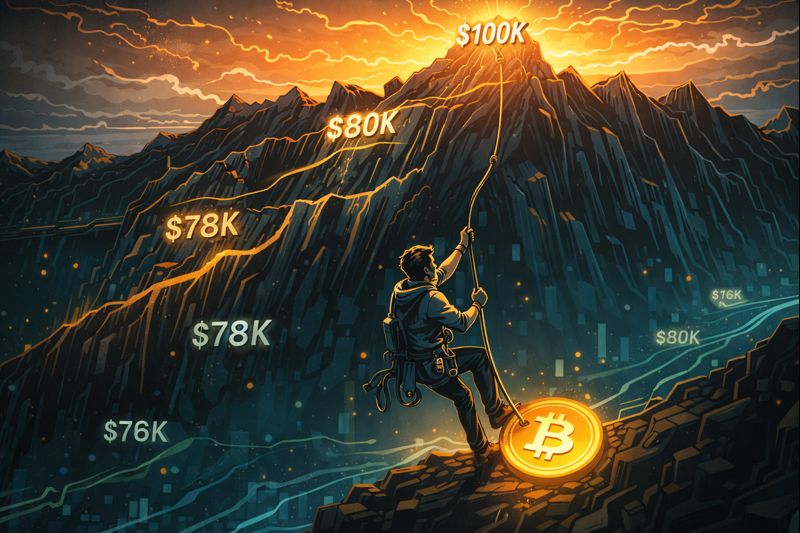

A fresh Bitcoin price forecast based on Wyckoff principles suggests the possibility of a dip below $80,000 this week, highlighting market structure, liquidity dynamics and risk management strategies for traders amid consolidation.

Traders caution that XRP’s potential run toward $10 won’t be swift, pointing to structural resistance, slower momentum, and evolving market conditions, but long-term conviction still drives optimism among some holders.

Bitcoin prediction markets are signaling that a $100,000 BTC price is not currently priced in, reflecting trader caution and macro uncertainty even as long-term narratives remain alive.

French police are investigating a data breach at crypto tax platform Waltio after hackers claimed to steal personal information from around 50,000 customers, prompting warnings about privacy risks and possible exploitation of exposed contact data.

A new DePIN initiative on Solana is building a decentralized sensor network using self-driving cameras and robotics, aiming to create a blockchain-native marketplace for real-world data with crypto-based incentives for participants.

A large 17,000 BTC inflow into exchange wallets has triggered concerns about potential selling pressure. Traders and analysts weigh what this could mean for short-term price action and broader market dynamics.

The Bitcoin-to-gold ratio has reached historically low levels as gold significantly outperformed Bitcoin in 2025, leading some analysts to say that true upside opportunities in BTC relative to gold are uncommon and require careful context.

Former Alameda Research CEO Caroline Ellison has been released from federal custody after serving part of her sentence, marking a significant milestone in the ongoing fallout from the FTX collapse.

RedStone, a leading oracle and data infrastructure provider, has acquired Security Token Market and the TokenizeThis conference is to deepen its role in institutional tokenization and strengthen its presence in the U.S. real-world asset sector.

Ray Dalio, the billionaire founder of Bridgewater Associates, warned at the World Economic Forum that the traditional fiat system is under strain as banks shift away from holding paper money, and gold’s performance reflects deeper macroeconomic pressures.

Ethereum co-founder Vitalik Buterin says protocol complexity is becoming a hidden threat to the network’s core principles and calls for a “garbage collection” approach to simplify and streamline the blockchain’s long-term development.

A massive social engineering attack saw a crypto investor lose more than $282 million in Bitcoin and Litecoin after being tricked into revealing their hardware wallet seed phrase, underscoring human vulnerability in digital asset security and the evolving tactics of high-value scammers.

Commerce platforms are exploring how blockchain and tokenization can transform traditional loyalty points into a portable, tradable asset class redefining customer engagement, cross-platform rewards, and digital ownership.

Binance Research outlines a second phase of institutional adoption for crypto, where investment strategies, infrastructure integration, and enterprise engagement evolve toward deeper, more sustainable participation in digital asset markets.

Analysts observing Bitcoin’s price action see a four-year cycle and power law behavior converging toward a potential retest of the $65,000 level reflecting long-term structural patterns amid short-term volatility.

BNY Mellon has launched tokenized deposits on an internal blockchain for institutional clients, marking a major push by a global bank to modernize payments, collateral, and settlement using programmable digital cash.

A $7 million breach of Trust Wallet highlights security weaknesses for crypto-friendly SMEs, underscoring the importance of wallet safeguards, decentralized risk management and savvy operational security in today’s digital asset environment.

Crypto treasury stocks often underperform the digital assets on corporate balance sheets, as market structure, sentiment, risk perception, and liquidity dynamics drive disproportionate moves in share prices compared to the underlying crypto holdings.