When Technical Structure Meets Market Reality

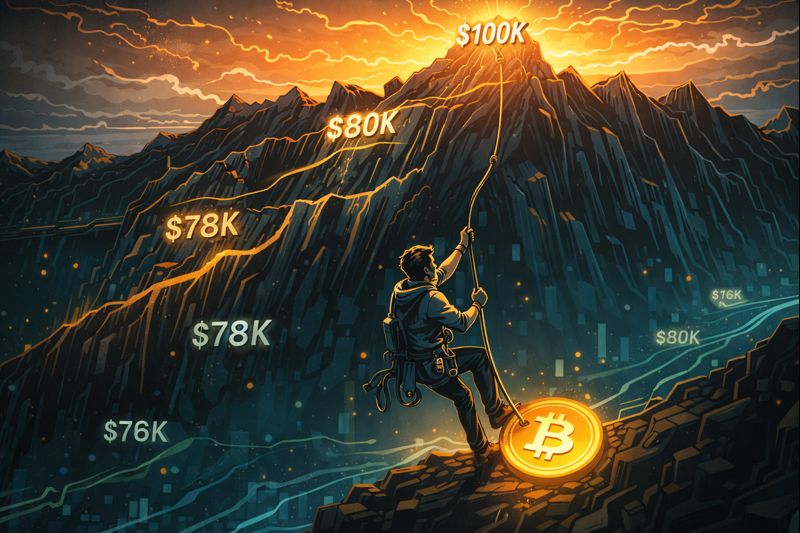

Whenever Bitcoin traders talk about big round numbers like $80,000, it gets attention, but real analysis comes when you dig into why certain levels matter. Recently, a fresh review of Bitcoin’s market structure using the Wyckoff method, a classic approach to understanding supply, demand, and market phases, pointed to the potential for a deeper pullback this week.

In plain language, this forecast isn’t about fear or hype. It’s about how price action, volume, and behavior around key levels are lining up in a way that suggests markets might want to test the downside before building a new base.

A move below $80,000, even briefly, doesn’t erase Bitcoin’s long-term narrative. Instead, analysts see it as part of a natural process where price finds support, absorbs selling pressure, and resets conviction before, potentially, another leg up.

What the Wyckoff Framework Is Seeing

The Wyckoff method is about cycles: accumulation, markup, distribution, markdown, and then back again. It’s less about exact price targets and more about patterns, liquidity, and how market participants shift behavior.

Here’s what the current structure looks like through that lens:

Consolidation zones: Bitcoin has spent several weeks in a range, with $80,000 often cited as a psychological and structural reference point.

Volume patterns: Price moves without strong volume tend to struggle to hold major support or resistance, indicating markets might need a deeper reset.

Liquidity tests: Downward probes are often part of a larger process to test where buyers truly step in, rather than shallow swings that keep traders guessing.

From a Wyckoff perspective, Bitcoin’s recent price action resembles a phase where selling has absorbed buying at higher levels, suggesting that a deeper test of support potentially under $80K could unlock greater clarity for the next phase of accumulation.

Why a Pullback Doesn’t Mean Market Weakness

It’s critical to separate technical correction from market collapse. Bitcoin’s long-term trajectory has been defined by volatility cycles and swings that look scary on the charts but historically serve to shake out weaker hands and solidify conviction among longer-term holders.

If the price dips below $80,000 this week, consider a few things:

Bitcoin is still above multiple longer-term moving averages that have acted as macro supports in past cycles.

Periodic drawdowns within broader upward trends are normal and can help markets build deeper foundations.

A move below a major psychological level can catalyze new narratives, refresh liquidity at lower prices, and clarify where real buying interest emerges.

None of this guarantees a rebound, but it frames a deeper pullback as structural information rather than a breakdown of fundamentals.

How Traders Are Framing Their Risk

When forecasts like this circulate, traders generally fall into three camps:

1. Defensive traders: Those who tighten stops, reduce leverage, and wait for clearer signals.

2. Tactical re-entry players: Traders who plan scaled buys at defined support bands to manage risk.

3. Long-term holders: Investors focused on conviction beyond daily swings, often paying closer attention to adoption metrics, narrative shifts, and macro drivers.

All three approaches can coexist in the same market. Bitcoin’s price history shows that volatility often spikes locally as participants disagree on direction and then settles into clearer patterns once key levels are tested.

What Could Change the Forecast

Forecasts aren’t fate. Several developments could shift the outlook quickly:

A macro surprise such as policy actions affecting risk assets could bolster Bitcoin’s bid and keep prices higher.

Renewed institutional flows: if large allocators enter or re-enter via regulated vehicles, it could add buying pressure near current ranges.

Liquidity events, smaller markets, or derivative imbalances can create sharp moves in either direction before settling.

Traders who watch Wyckoff structures typically combine technical context with real-world information, rather than relying strictly on pattern recognition. This adaptive viewpoint keeps them ready for quick shifts in narrative.

The Human Side of Market Phases

One thing charts don’t capture but traders definitely feel is confidence and psychology. When markets approach major levels like $80,000, emotions come into play:

Some feel relief on support holds.

Others second-guess moves downward.

Some decide now is the time to commit more capital.

What separates disciplined participants from distracted ones is plan and perspective: set levels, manage risk, and watch how price behaves around those levels, rather than what it might do.

That’s a subtle but powerful difference, and it’s exactly what methods like Wyckoff aim to teach.