Bridging Africa’s Financial Divide with Blockchain

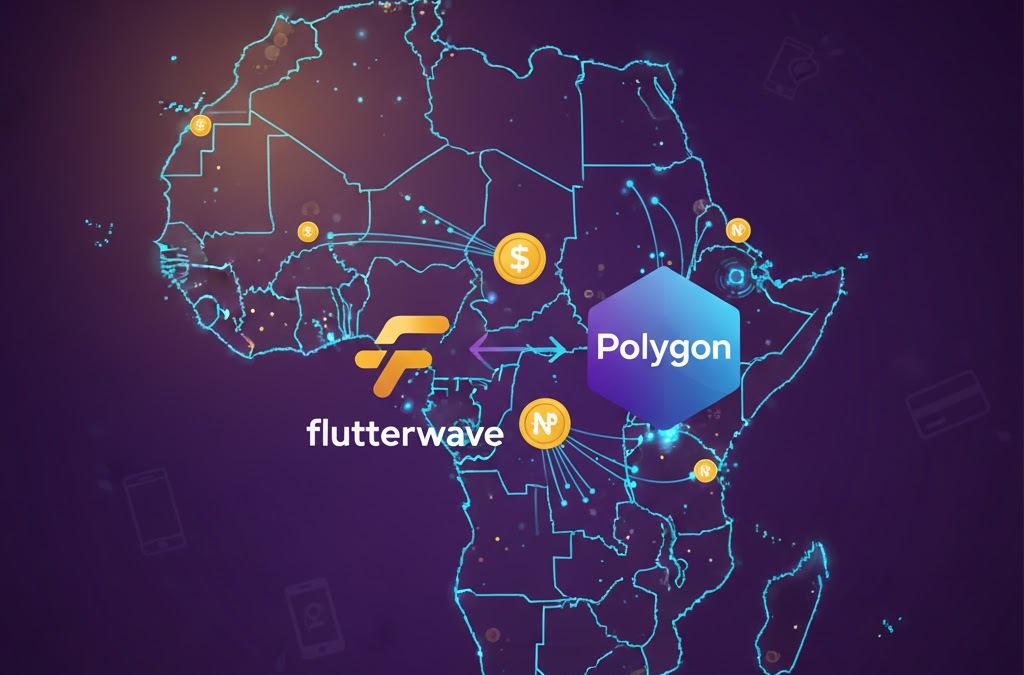

In what could become one of Africa’s most significant fintech developments to date, Flutterwave is reportedly preparing to launch a cross-border payment system built on stablecoins. The initiative, developed in partnership with Polygon Labs, will span 34 African countries, marking an ambitious push to merge blockchain innovation with practical financial infrastructure on the continent.

The collaboration, first reported by Bloomberg, reflects a growing belief among fintech leaders that blockchain-based payments can solve long-standing challenges in African finance: high remittance costs, fragmented banking systems, and delays in international settlements. By leveraging Polygon’s Ethereum-based scaling technology, Flutterwave intends to create a payment layer that is both faster and more cost-effective than existing channels.

“Stablecoin adoption will drive more flows into Africa,” said Olugbenga Agboola, co-founder and CEO of Flutterwave. “This initiative has the potential to 10x the volumes we are currently doing.”

Africa’s $100 Billion Remittance Challenge

Remittances are a cornerstone of Africa’s financial ecosystem. According to the World Bank, sub-Saharan Africa received over $54 billion in remittances in 2024, with millions relying on these funds for daily expenses, education, and healthcare. Yet, transferring money across borders remains one of the most expensive financial activities in the world.

Traditional money transfer services charge fees ranging from 8% to 12% on small transactions, often taking several days to clear. By contrast, stablecoin transactions settle within minutes and cost a fraction of a dollar, making them an increasingly attractive alternative.

A 2024 Chainalysis report found that sending a $200 remittance via stablecoins in sub-Saharan Africa was roughly 60% cheaper than through conventional channels. The same report revealed that on-chain activity in the region surged in March 2025, even as other parts of the world saw declines. Analysts attribute the growth to currency volatility in major African economies like Nigeria and Ghana, where locals are using USDT and USDC to hedge against inflation and preserve purchasing power.

Why Stablecoins, Why Now?

Stablecoins—digital assets pegged to the value of fiat currencies like the US dollar—have emerged as a bridge between traditional finance and the blockchain economy. Their predictable value and ease of transfer make them ideal for everyday payments and remittances, particularly in regions where access to stable local currency is limited.

In Africa, where nearly 60% of adults remain unbanked or underbanked, stablecoins offer a means of financial inclusion without traditional intermediaries. For freelancers, small businesses, and diaspora families, stablecoin transfers bypass foreign exchange restrictions, cut out middlemen, and operate around the clock.

“Stablecoins can transform the way money moves across borders,” said Adedayo Thomas, a Lagos-based fintech analyst. “They remove friction from the system and allow individuals and businesses to transact in a currency that holds its value, even when local markets are unstable.”

The Role of Polygon in Africa’s Blockchain Push

Polygon Labs, the technology partner in this initiative, has long been seen as a gateway for Web3 scalability. Built as a layer-2 network for Ethereum, Polygon enables faster and cheaper transactions while maintaining compatibility with the world’s most used smart contract blockchain. Its infrastructure is already used by major brands such as Nike, Mastercard, and Starbucks for tokenization, payments, and loyalty systems.

By integrating with Polygon, Flutterwave aims to create a seamless payment experience that combines blockchain’s efficiency with the familiarity of fintech interfaces. The system will allow users to send, receive, and settle payments in stablecoins pegged to the US dollar, while businesses can choose to convert funds into local currencies or hold them digitally.

Polygon’s role is not merely technical; it represents a philosophical shift toward open financial rails, where users across nations can interact on a shared, decentralized infrastructure rather than within siloed national banking systems.

“Polygon’s partnership with Flutterwave is a validation of how public blockchain networks can support real-world use cases,” said Mihailo Bjelic, co-founder of Polygon Labs, in a previous interview on similar partnerships. “Africa is ready for scalable, low-cost payment rails that actually work for people.”

The Context: Rising Stablecoin Adoption in Africa

Africa has become a global leader in grassroots crypto adoption, despite regulatory uncertainty in several markets. Countries like Nigeria, Kenya, and Ghana consistently rank in the top 10 of the Global Crypto Adoption Index, driven by practical use cases rather than speculation.

Much of this activity revolves around stablecoins. In Nigeria, stablecoins are widely used for merchant payments, savings, and peer-to-peer transfers, while freelancers often receive international payments in USDT or USDC. In Kenya, digital payment platforms are experimenting with blockchain-based mobile money integrations, blending Web3 with the continent’s long-established mobile finance ecosystem.

The devaluation of local currencies, such as the Nigerian naira and Ghanaian cedi, has further fueled demand for dollar-denominated digital assets. As inflation erodes local purchasing power, stablecoins offer a digital safe haven that is both liquid and portable.

Flutterwave’s Strategic Vision

For Flutterwave, which already processes billions in annual transaction volumes, the partnership with Polygon represents a strategic evolution from fintech innovator to blockchain infrastructure provider. The company, founded in 2016, built its reputation by helping global firms like Uber, Microsoft, and Booking.com process payments across African markets. Its next phase—embedding blockchain into its core—could redefine its role in Africa’s financial future.

Agboola believes that blockchain’s transparency, combined with Flutterwave’s regulatory expertise and network reach, could set a new standard for cross-border finance. “Our goal is to make stablecoin payments as intuitive as sending a text message,” he said during a panel at the 2025 Africa Fintech Summit. “This is not just about crypto; it’s about enabling commerce.”

The Regulatory Landscape: From Skepticism to Engagement

One of the biggest hurdles to blockchain adoption in Africa has been regulatory uncertainty. Central banks in countries like Nigeria and Kenya initially cracked down on crypto activity, citing concerns over volatility and illicit finance. However, as stablecoin adoption has continued to grow organically, governments are beginning to shift their stance.

Nigeria’s Central Bank Digital Currency (eNaira) pilot, though limited in scope, opened dialogue around tokenized money. In 2025, the Nigerian Securities and Exchange Commission (SEC) began exploring stablecoin regulations, recognizing them as “digital representations of fiat-backed value” rather than speculative assets.

This gradual softening of attitudes mirrors trends across the continent. In Ghana, regulators are working on frameworks for digital asset custody; in Kenya, authorities are consulting on crypto tax guidelines; and in South Africa, stablecoins are being evaluated as part of the Intergovernmental Fintech Working Group’s sandbox.

The Flutterwave–Polygon initiative could become a test case for how compliant blockchain-based payments might operate at scale in Africa, bridging fintech, Web3, and policy ecosystems.

From Remittances to Enterprise Payments

While remittances are the most visible use case, Flutterwave’s ambitions extend further. The company envisions stablecoins facilitating B2B settlements, e-commerce, and trade finance, particularly for small and medium-sized enterprises (SMEs) that face barriers in accessing dollar liquidity.

With over 100 million SMEs across Africa, many operating informally or without robust access to banks, stablecoin payments could become a backbone for intra-African trade. Businesses could invoice, settle, and hold reserves in digital dollars, reducing exposure to local currency swings and easing cross-border trade under frameworks like the African Continental Free Trade Area (AfCFTA).

“Stablecoins could unlock trade in a way SWIFT never could,” said Kwame Adusei, a fintech consultant based in Accra. “For the first time, we might see a decentralized payment system that truly works across 30-plus countries.”

The Road Ahead

As Flutterwave and Polygon prepare to roll out their system, questions remain about user education, compliance, and infrastructure integration. Stablecoin payments require reliable Internet access, secure digital wallets, and regulatory clarity, all still uneven across parts of the continent.

Yet, the momentum is undeniable. With a youthful, mobile-first population, rising Internet penetration, and a history of leapfrogging traditional financial models (as seen with M-Pesa in Kenya), Africa is well-positioned to define the next chapter of digital payments.

If successful, Flutterwave’s partnership with Polygon could make stablecoin-powered remittances as common as mobile money and place Africa at the forefront of global fintech innovation.

Key Takeaway

Flutterwave’s partnership with Polygon Labs represents more than a technical collaboration; it’s a symbol of Africa’s accelerating digital transformation. By embedding stablecoin payments into everyday commerce, the initiative could redefine how money moves across borders, empower small businesses, and give millions a pathway to participate in the global economy.